NEWS

Wednesday 17 November 2021

Download article as PDF

Has the COVID pandemic made workers more likely to embrace non-traditional work patterns?

Our new research suggests it has, but 79% also say they have gaps in the benefits and protections they need.

For many years there has been a lot of discussion about the way people work and the future of the workplace. The COVID pandemic and fallout from it has accelerated this conversation – largely due to the sudden and unexpected shift to home working and the flexibility that comes with it.

And with many now demanding the flexibility that they’ve become accustomed to in recent months, lots of workers are turning away from traditional “employment” and looking for something different.

Of course, this is an important issue for multinationals and potentially a challenge. If people – as our survey results suggest – are now more likely to embrace non-traditional ways of working, how do employers cater for that in terms of employee benefits and protections. Are they able to provide the benefits nontraditional workers want and need? And if not, do they need to start getting ready to do so?

When you think about non-traditional working, your mind might instantly jump to the gig economy. But gig work – where workers get paid for each “gig” or task they complete rather than earning a standard regular wage1 – is just one small part of the non-traditional working landscape.

Non-traditional working also includes freelancers and contractors – really anyone who doesn’t have a traditional full-time employment contract. And these workers are many.

They make up an important and highly skilled part of a multinational’s workforce. They are project managers, web designers, health workers, consultants, accountants and lawyers, to name just a few examples. In reality, they can fill almost any job in a multinational company and the number of these workers only seems to be going in one direction – up!

However, one of the problems faced by these workers is the protection gap. Often those that sit outside of traditional employment don’t receive many, or any, employee benefits – like life, medical, accident and disability insurance, and pensions – leaving them without the critical protection they need in difficult times.

Given the growing demand for flexibility from workers, we wanted to take a look at the world of non-traditional work, benefits and more in this Viewpoint. To help find out what workers think, we’ve conducted some new, global research too… but more on that later.

Non-traditional working also includes freelancers and contractors – really anyone who does’t have a traditional full-time employment contract.

Defining non-traditional workers

The US Bureau of Labor Statistics (BLS) defines non-traditional work in a few ways. Its definition includes:

- unincorporated self-employed workers such as lawyers, farmers and carpenters and incorporated self-employed workers who often employ others

- contingent workers, defined as those who do not expect their job to last for more than a year

- people with alternative working arrangements such as independent contractors, workers on call and those employed by contract firms or temp agencies

- people connected to clients through a website or app – sometimes known as the platform economy. That means drivers connecting to rides through platforms like Uber or repair people and cleaners working through TaskRabbit, as well as those working online for Amazon Mechanical Turk or Upwork.2

From our perspective – anyone who sits outside of permanent, regularly paid employment is a non-traditional worker.

So, now we know non-traditional working covers more than gig workers like Uber drivers, we can see how they become a major part of the workforce of a multinational organisation. Take Google, for instance. The tech giant has more freelancers than permanent employees. And it isn’t just Google – hiring managers expect that work done by freelancers is likely to double in the next decade.3

Mind the gap… non-traditional workers need more protection

As we’ve mentioned, this group of workers is growing and flexible ways of working are becoming more popular – therefore the employee benefits challenge here grows too.

As Helga Viegas, Director of Digital & Innovation at MAXIS GBN said, “Multinationals are relying more and more on non-traditional workers – contractors, freelancers, gig workers, global nomads – alongside workers with a traditional permanent contract. It’s known that many non-traditional workers don’t have adequate insurance coverage, pension provision and more. Without the conventional benefits provided by an employer, these workers face a massive protection gap, and the pandemic has made this issue much more evident. Many employers want to do more to protect all of their workers, but this isn’t always easy.”

“Without the conventional benefits provided by an employer, these workers face a massive protection gap and the pandemic has made this issue much more evident.”

Naturally, this is a subject that interests us and our global multinational clients, so we conducted some global research to find out more about the views of workers on non-traditional work and employee benefits. We surveyed more than 1,200 workers from eight countries around the world to find out what they think.

More than three quarters (79%) of people currently in non-traditional and part-time work say there are gaps in their benefits; rising to 86% for 18-29-year-olds and 83% for female respondents. The most commonly identified gaps in benefits are private medical insurance (23%) and pensions (27%), with over half of respondents identifying these areas as lacking.4

This finding isn’t that surprising, either. In the UK it is estimated that just 16% of self-employed workers currently have pensions – this number was 48% in 1998. People in traditional employment in the UK are four times more likely to have retirement savings than the self-employed.5 And, of course, there’s also the lack of security around medical bills, no contingency for long-term absence, disability and more.

Many employers have realised that the protection gap is a problem that needs to be addressed. One example is Deliveroo. The restaurant delivery platform has started offering some protection insurance to drivers while other prominent gig economy businesses are grappling with the issue and are facing pressure from contractors for some form of employment rights.6

Helga Viegas continued, “Multinationals – and their EB consultants – particularly since the pandemic, have started coming to us asking how they can prepare and offer benefits packages for these groups and all their workers whether they are technically ‘employees’ or not.

“We’re looking into ways we can help them offer flexible benefits to these groups around the world, by curating a suite of appropriate products and services and offering the technology to deliver them.”

Non-traditional workers are valuable to multinationals and, with the ongoing war for talent becoming ever greater, providing benefits for non-traditional workers could be a good way to attract the people with the skills they need. But what role can employers play in providing benefits and what benefits would be most valuable?

79% of people currently in non-traditional and part-time work say there are gaps in their benefits.

Non-traditional workers and benefits

Some might think that non-traditional workers don’t want benefits because of complicated tax arrangements or because they have their own insurance coverage and pension plans. But our research shows that isn’t the case.

Nearly half (47%) of those surveyed said they would be more likely to consider non-traditional work if benefits were provided. 35% say it would make no difference and just 19% say they would be less likely to consider non-traditional work as a result.4

47% said they would be more likely to consider non-traditional work if benefits were provided.

Of course, if doesn’t necessarily have to be employers providing benefits – governments around the world already play a role in this and could extend protection to these workers. However, data from the International Labor Organisation shows that when governments do provide social protection for non-traditional workers, it is at a lower level than traditional employees receive, and it lags behind that of employees in most countries.7

So, who should finance benefits for these workers? Our research shows people believe it is the responsibility of the employer. 43% of our survey respondents (which contained a mix of full-time employees and non-traditional workers) believe employers should be responsible for paying for benefits, compared with 24% who believe it’s the role of governments and just 14% who believe it is down to the employee.4

Employees at multinationals agree – 44% said they believe it’s the employer’s role to fund benefits for non-traditional workers. Views were relatively uniform across the countries, except in Indonesia. 25% of respondents there think benefits should be provided by employers compared with 36% who believe it should be the government’s responsibility.4

Which benefits should employers focus on?

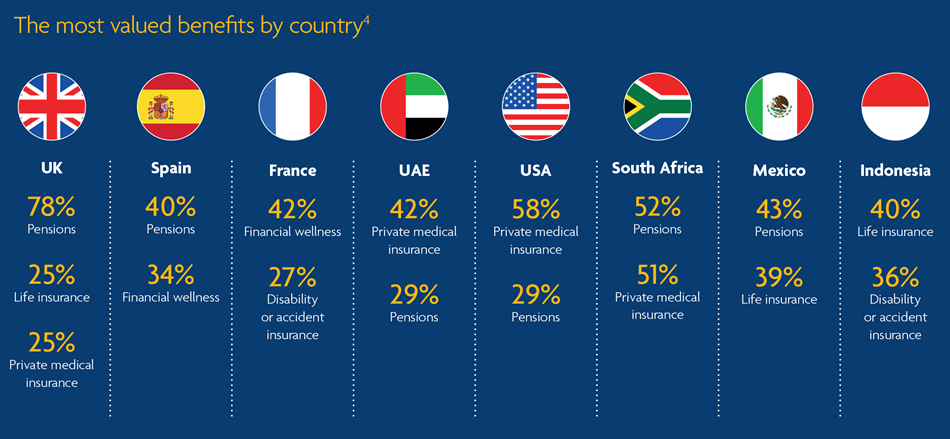

Of course, if you are going to start offering benefits, you want to make sure you’re offering the ones that are most valued by these workers. Our research found some common themes in all eight markets – there’s strong demand from workers for private medical insurance and pensions.

Globally, 40% chose pensions as the benefit they value the most, closely followed by private medical insurance which was chosen by 36%. However, it seems there is real demand for comprehensive benefits packages – similar to those permanent employees receive – as respondents voted for an array of other benefits as their preferred choices. 29% voted for life insurance, 28% for financial wellness, while disability, accident insurance and health and wellness programmes were all mentioned by 22% of respondents.4

It seems there is real demand for comprehensive benefits packages – similar to those permanent employees receive …

Our data, once again, shows that one size does not fit all in the world of employee benefits. Respondents’ views differed depending on age, seniority and, of course, location. For example, in the UK, respondents overwhelmingly said they value pensions over other benefits – probably due to the availability of the National Health Service (NHS) – whereas in countries without a state health service, such as the USA, private medical insurance is more popular.

COVID-19 and non-traditional work

During lockdowns non-traditional workers were often badly hit as they did not have access to sick pay and were not eligible for schemes such as furlough payments in the UK which guaranteed 80% of their average pay to employees. Research by The Pew Charitable Trusts found that more than 40% of non-traditional workers had hours cut or lost jobs because of COVID-19 in the US and around 10% withdrew money from their defined contribution workplace pension funds or Individual Retirement Accounts (IRAs) in order to top up their finances.8

UK data found non-traditional workers were a “particularly vulnerable group” and between April and August 2020 hours and incomes remained significantly lower than in the previous year despite the gradual reopening of the UK economy. As a result, a fifth of workers said they would leave non-traditional work.9

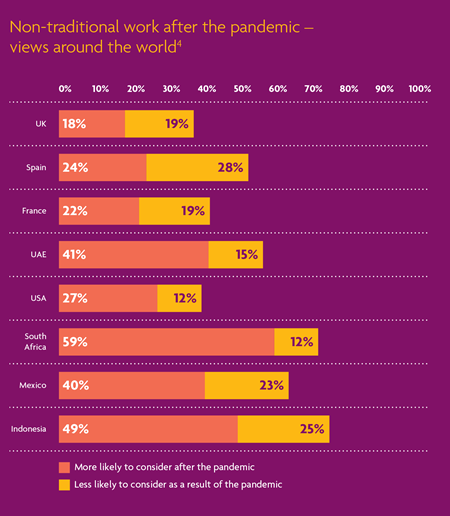

But our research found that the appetite for non-traditional work is high and people don’t seem to have been deterred by the pandemic. 35% of our respondents said they are more likely to participate in non-traditional work as a result of the pandemic with 18% saying they are much more likely. Only 19% said they are less likely to consider it, with only 12% saying they are much less likely.4

And the figure barely changes among those currently in full-time employment– 34% are more likely to consider non-traditional work after the pandemic. And that number goes up to 37% if we look just at those working for multinationals.4

35% of our respondents said they are more likely to participate in non-traditional work as a result of the pandemic with 18% saying they are much more likely.

While this might, at first, seem surprising – employees leaving the safety net of a full-time role with benefits for non-traditional work – there might be a few reasons why people are keen to undertake non-traditional work.

Some workers may have taken up non-traditional work during lockdowns to supplement their income. Others may simply have enjoyed the greater flexibility that working from home provided and are turning to non-traditional work to maintain this flexibility going forward.

Whatever the reason, it seems that not even a global health crisis can slow down the growth of the non-traditional work economy!

...it seems that not even a global health crisis can slow down the growth of the non-traditional work economy!

What does this mean for multinational employers?

While this new data makes for an interesting read and hearing views from around the world is fascinating, what you really want to know is what this means for you as a multinational employer. Here’s what we think…

- The world of non-traditional work is growing and, even after a pandemic that has bought many unknowns and less job security, people are still willing (if not more willing) to embrace it.

- Whether skilled or unskilled, these workers make up a vital part of most multinational employers’ workforces

- There’s a growing protection gap that leaves non-traditional workers vulnerable

- Providing benefits to these workers can help to attract the best talent and keep them happy, healthy and motivated in their roles

- The most sought-after benefits are private medical insurance and pensions globally, but employers need to bear in mind regional and national views on the most valued benefits.

People are choosing non-traditional work because it suits their lifestyles, but this creates a challenge for employers. If they want to recruit and retain these workers, they will need well-designed employee benefits packages to help them.

Multinationals and employee benefits professionals are recognising this and are starting to react. However, to deliver valued benefits for all workers and make this a reality, it will be up to all players in the employee benefits industry to play their part – employers, brokers, consultants, insurers and employee benefits networks. And the need to embrace the innovative digital solutions that will make this possible is vital.

Whatever these programmes finally look like, we think it’s safe to say that there is a real demand for benefits for non-traditional workers and now is the time to start taking action.

How we did the research4

The survey was carried out online with workers in the UK, Spain, France, United Arab Emirates, USA, South Africa, Mexico and Indonesia.

Respondents were asked about the type of organisation they worked for – global multinationals, regional large corporates, single market large corporates, single market mid-sized corporates and single market small businesses.

The research was conducted between 18 October and 25 October 2021, with the sample consisting of 66% full-time employees, 12% part-time employees and 21% non-traditional workers.

1 Bill Wilson, BBC https://www.bbc.co.uk/news/business-38930048 (sourced November 2021)

2 Patrick Coate & Laura Kersey, NCCI https://www.ncci.com/SecureDocuments/QEB/II_Insights_QEB_2019_Q2_Drilling_Down.html (sourced November 2021)

3 Varun Omprakash, Flexiple https://flexiple.com/freelance/freelance-statistics-and-trends-2020/ (sourced November 2021)

4 MAXIS GBN conducted research with 1,205 employee workers in October 2021 based across the UK, USA, UAE, France, Spain, South Africa, Mexico and Indonesia with equal weighting across regions. The research was undertaken online by an independent third party.

5 Rowena Crawford and Heidi Karjalainen, Institute for Fiscal Studies https://ifs.org.uk/publications/15103 (sourced November 21)

6 Anon, Deliveroo https://riders.deliveroo.co.uk/en/support/insurance/what-is-covered-by-deliveroo-insurance (sourced November 21)

7 Anon, International Labour Organization https://www.ilo.org/wcmsp5/groups/public/---dgreports/---ddg_p/documents/publication/wcms_742290.pdf (sourced November 21)

8 Alison Shelton, Pew Charitable Trusts https://www.pewtrusts.org/en/research-and-analysis/articles/2021/04/21/more-than-40-of-nontraditional-workers-had-hours-cut-or-lost-jobs-because-of-covid-19 (sourced November 21)

9 Jemma Smith, Prospects https://www.prospects.ac.uk/jobs-and-work-experience/self-employment/self-employment-and-covid-19 (sourced November 21)

This document has been prepared by MAXIS GBN and is for informational purposes only – it does not constitute advice. MAXIS GBN has made every effort to ensure that the information contained in this document has been obtained from reliable sources, but cannot guarantee accuracy or completeness. The information contained in this document may be subject to change at any time without notice. Any reliance you place on this information is therefore strictly at your own risk. This document is strictly private and confidential, and should not be copied, distributed or reproduced in whole or in part, or passed to any third party.

The MAXIS Global Benefits Network (“Network”) is a network of locally licensed MAXIS member insurance companies (“Members”) founded by AXA France Vie, Paris, France (AXA) and Metropolitan Life Insurance Company, New York, NY (MLIC). MAXIS GBN, a Private Limited Company with a share capital of €4,650,000, registered with ORIAS under number 16000513, and with its registered office at 313, Terrasses de l’Arche - 92 727 Nanterre Cedex, France, is an insurance and reinsurance intermediary that promotes the Network. MAXIS GBN is jointly owned by affiliates of AXA and MLIC and does not issue policies or provide insurance; such activities are carried out by the Members. MAXIS GBN operates in the UK through its UK establishment with its registered address at 1st Floor, The Monument Building, 11 Monument Street, London EC3R 8AF, Establishment Number BR018216 and in other European countries on a services basis. MAXIS GBN operates in the U.S. through MetLife Insurance Brokerage, Inc., with its address at 200 Park Avenue, NY, NY, 10166, a NY licensed insurance broker. MLIC is the only Member licensed to transact insurance business in NY. The other Members are not licensed or authorised to do business in NY and the policies and contracts they issue have not been approved by the NY Superintendent of Financial Services, are not protected by the NY state guaranty fund, and are not subject to all of the laws of NY. MAR00930/1021