NEWS

Tuesday 14 September 2021

You’ve probably read countless articles and listened to numerous podcasts, webinars and event keynote speeches about “diversifying your captive with employee benefits”. Chances are you know that multinationals have added employee benefits (EB) lines of business to their captives – primarily set up to manage their property and casualty (P&C) insurance risks – for a number of years now. And by doing so, they’ve been able to get centralised control of EB costs and diversify the captive. A definite win-win situation for everyone involved.

But something you might not have heard as much about is the trend of companies setting up captives just to manage EB risks – life, accident, disability, and medical insurance. A quick Google search shows there’s not much being said out there at the moment about EB-only captive programmes, so we thought it would be interesting to look at this relatively new trend and find out if it’s still necessary to have P&C business in a captive or if EB-only can work just as well.

In case you haven’t heard much about captives before…

What is a captive?

Non-insurance companies are increasingly setting up their own insurance or reinsurance companies – captives – to insure their business’ risks. Simply put, captives are a form of risk retention that is used to aggregate premium and losses.

Using a captive can be more cost effective by retaining risk that the insurance market has priced at a high rate and capturing the underwriting profits. Captives can cover a wide range of risks and help control the insurance premium budget for multinationals.

According to Marsh the number of captives grew in 2020 and that rise is continuing in 2021, too. And, according to Ellen Charnley, President of Marsh Captive Solutions, part of the growth is because of the versatility of a captive. “We can pretty much do anything in a captive. You may or may not need a front, or you may or may not need a rating. The question is, ‘Does it make sense, is there value to it?’”1

“We can pretty much do anything in a captive. The question is ‘Does it make sense, is there value to it?’”

The growing use of captives for EB

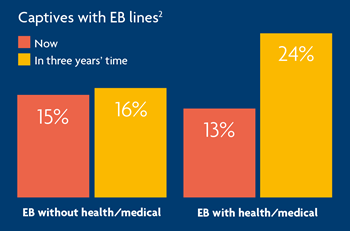

Before we look at the case for EB-only captives, it’s worth pointing out the growing trend of adding EB to an existing captive. According to Aon, EB risks captured in a captive have grown in popularity globally with health and medical benefits leading the charge.2

Before we look at the case for EB-only captives, it’s worth pointing out the growing trend of adding EB to an existing captive. According to Aon, EB risks captured in a captive have grown in popularity globally with health and medical benefits leading the charge.2

Marsh mentioned that one stand-out growth area for their captive portfolio is medical stop-loss coverage. This business line saw 81% growth.1

And it isn’t just the brokers and consultants who are noticing the growing trend of adding EB to a captive. At MAXIS GBN, we’ve seen our captive portfolio grow massively in the last five years. Now, we manage more than 55 captive programmes globally and are seeing lots of interest from multinationals looking to move to the captive model. And multinationals that already have EB business in their captive are still looking to add new lines of business and new countries to their programme.

Starting a captive programme for EB – Facebook’s story

While it seems there’s plenty of appetite to add EB to a captive, what about starting an EB-only captive? How does it actually work in practice when a multinational starts a captive programme primarily for EB risks?

Rather than speculating or giving you the theory, we spoke to Janaize Markland, Director, Business Risk & Insurance at Facebook, to find out about their journey to an EB-only captive programme.3

How did the idea for an EB-only captive start?

How did the idea for an EB-only captive start?

Janaize Markland (JM) “A couple of years before I joined Facebook, the HR benefits team completed a feasibility study that looked at the potential benefits of using a captive to be able to provide a wide range of consistent employee benefits across our global footprint. The study also showed that by using a captive, we could realise some potential premium savings, and that was attractive to us.”

“The primary focus of the feasibility study was EB, with the caveat that once the captive was in place, we would be interested in exploring opportunities with other lines of business too.”

Before you started the captive programme how were EB risks managed at Facebook?

Before you started the captive programme how were EB risks managed at Facebook?

JM: “Strictly speaking we didn’t have an overall pooling strategy. We had natural pools that formed over time, but for the most part it was local partners working contract-by-contract. Our benefits team was seeing the loss development and identifying issues across the pool. That led us to exploring the captive route. Over the past few years, the benefits team has gotten a real handle on the population and the risk, and we were able to get comfortable with a captive model pretty quickly.”

“Over the past few years, the benefits team has gotten a real handle on the population and the risk, and we were able to get comfortable with a captive model pretty quickly.”

You mentioned offering consistent and improved benefits as being a main driver for starting the captive… what are your goals for your captive programme?

You mentioned offering consistent and improved benefits as being a main driver for starting the captive… what are your goals for your captive programme?

JM: “Our captive objectives are to be solvent, efficient and helpful. We are here to enable the business, reduce administrative burden, and to get a better view of the risks. And then, as I mentioned before, it’s about trying to standardise our benefits as best we can. There are some regulatory and compliance challenges in some areas, but we are working on level-setting our benefits across our international locations to the extent we are able.”

What steps did you have to take to get the captive set up?

JM: “We set ourselves the goal of submitting our application to the Department of Insurance in Hawaii, our chosen domicile, by the end of 2020. In December, we had our Certificate of General Good and were able to place a small property policy into the captive which provided us with a bit of a head start on considering US employee benefits for captive placement.

JM: “We set ourselves the goal of submitting our application to the Department of Insurance in Hawaii, our chosen domicile, by the end of 2020. In December, we had our Certificate of General Good and were able to place a small property policy into the captive which provided us with a bit of a head start on considering US employee benefits for captive placement.

“We exceeded our expectations due in large part to the great team we had helping us set everything up and the captive regulator in Hawaii. The Department of Insurance in Hawaii was helpful, responsive and generally great to work with.”

So, the first policy you placed in the captive was a P&C risk… what policies are next for your captive?

So, the first policy you placed in the captive was a P&C risk… what policies are next for your captive?

JM: “When it came to determining what to put into the captive first, we landed on life, accident and disability as the primary lines to focus on. Medical is a little trickier because it is a highly personal benefit that gets used relatively frequently. Any change to providers or benefits delivery requires a very thoughtful process and a lot of change management. All that takes time.”

And, of course, the pandemic must be playing a role in your decision-making process?

JM: “We’ve been thinking about how we evaluate and accept risks into the captive, how we know it’s a good risk to take. And all that would have been much more straightforward if not for a global pandemic during our first year of captive operations. So, we’ve had to assess how COVID changes our view of the risk and what that means over the longer term. So, to make us feel a little bit better, we are using a lot of benchmarking and competitive quoting to determine if the premiums are in the ballpark of reality given the COVID situation.

“We’ve been applying additional scrutiny, asking another level of questions, just to make sure we’re comfortable with what policies are going in.”

What is driving the adoption of EB captives?

The Marsh 2020 Captive Landscape Report highlighted that captive adoption in general is being driven by an increasingly difficult risk and insurance landscape partly due to the impact of COVID-19.4

The pandemic may be a factor in the increased interest in EB-only captives, too. Mark Cook from Willis Towers Watson told the Global Captive Podcast “We’ve implemented three captives in the last 12 months in different regions, but these captives are EB-only.

“They may morph into wider non-life and life captives, but the business case was big enough to implement a captive for EB and a lot of it has been prompted by what the pandemic has brought and what the company now needs to do in terms of offering to its employees on benefits.5

“…the business case was big enough to implement a captive for EB and a lot of it has been prompted by what the pandemic has brought and what the company now needs to do in terms of offering to its employees on benefits.”

Creating a minimum standard of benefits globally

The ability to price their own risk and retain underwriting profits is always going to be a draw for multinationals to move towards the captive model, but it’s by no means the only benefit. Changing employees’ benefits needs, the war for talent and, of course, the pandemic, mean employers are recognising they have a greater duty of care than ever before to look after employees and a captive may be the perfect way to help them do so.

Using a captive to write EB risks gives employers the opportunity to offer coverage that might not be available in some local markets or be unaffordable because of local pricing, such as transgender cover, HIV/AIDS cover, cover for same-sex partners and more. By using a captive, multinationals can set a minimum standard of benefits for employees regardless of the risk profile of their home country or region.

And that is exactly what Facebook is trying to do. Janaize Markland said: “We conduct regular employee benefits surveys to get employee feedback on the benefits Facebook offers. One area that we will be exploring over the coming months is benefits related to diversity and inclusion. The captive is very appealing because now we have that greater flexibility in what we can provide.”

“To be the best employer you have to offer a really competitive benefits package. And, in order to do better, you have to go the captive route because of what local partners are willing to do on their own.3

Facebook isn’t alone in trying to standardise benefits. Beauty giant L’Oréal, which employs 88,000 staff worldwide, established its ‘Share & Care’programme in 2012 with the specific aim of ensuring that all employees around the world have access to the best social protection, healthcare coverage and wellbeing at work.6

Manufacturer Saint Gobain offers ‘Care by Saint Gobain’ which provides minimum social protection for its 170,000 global employees and their families.7

“The flexibility of the captive is very appealing because now we can take the risk ourselves, we can have more control over free cover limits and have that greater flexibility.”

The challenges of setting up an EB-only captive

Of course, while it all sounds good in theory, there are undoubtedly going to be challenges in setting up an EB-only captive programme. Any company going down this route does have to start from scratch, including choosing a domicile and going through the various regulatory processes. It might not be as fast a start or as smooth a journey as those with an existing captive already in place looking to add EB lines of business.

Plus, going down the EB-only route means not having P&C risks to offset in the case of early losses – in some cases EB risks can be relatively high frequency compared with low frequency P&C risks. As Janaize Markland pointed out, starting an EB-only captive means you might need to be selective about what lines to place in the captive at the start.

However, Nicola Fordham, Head of Underwriting at MAXIS GBN, doesn’t think it’s an issue to not have P&C risks already in place in a captive before adding EB business: “There are plenty of insurers around the world that only provide employee benefits risks in one country. The fact that these local insurers are happy to underwrite and accept these risks suggest that EB can be written profitably and, give an employer looking to start a captive programme without existing P&C business, confidence that these risks can be written alone in a portfolio.

“The beauty of an employee benefits portfolio is that the risks are diverse and can naturally offset each other, as each country, employee populations and product lines are all having different experiences.

“Even in the face of a pandemic that has touched everyone around the world, we’ve seen overall a broadly balanced impact across our portfolio. Each country and each line of risk has had a different experience, some positive, some negative and some neutral.”

Advice for setting up an EB-only captive

Have a good captive implementation team – “[our captive implementation team] has been there as a sounding board for us and help us talk through our thought process, give us advice about what others are doing. So having a good captive implementation team is an absolute must.” Janaize Markland3

Know your risks – “It’s important to fully understand your risks. EB has the potential to be volatile as it can involve large sums of risk, so it’s important you have good visibility of the portfolio and know what risks you’re placing into the captive.” Nicola Fordham

Understand your broker contracts – “Find out if your broker contracts are set up to focus on compliance and benefits design, or if they are set up to be broking and placing insurance, because if you’re moving from a situation where you’re just placing insurance in local markets and then you’re using those same brokers to shift over to a captive model, their contracts may not be set up for the change in the business needs.” Janaize Markland3

Have a strong communications strategy – “EB is more than just transactional insurance as this is impacting people’s day to day lives. You need to have a strong communications strategy to make sure everyone is aware of any changes. Generally starting an EB captive needs full buy-in across the whole C-suite.” Nicola Fordham

Work with the right global benefits network – “Find an EB network that’s able to match most of your global footprint and is open to new things that you hope to provide in the future. Your EB network obviously needs to be able meet your needs today, but it also should be able to flex to accommodate the needs you will have in the future. Even if they can’t accommodate your future needs now, they need to be at least open to the possibility sometime down the road.” Janaize Markland3

While EB-only captives are a relatively new phenomenon, there are a growing number of multinationals taking advantage of the benefits for their EB risks alone. Even those without a P&C captive in place.

The opportunities to offer better benefits at a competitive rate and meet the changing demands of employees is particularly enticing. Setting up an EB-only captive can be challenging and needs careful planning, but global benefits networks are there to help support you in the process.

1 Anon, Captive.com https://www.captive.com/news/dramatic-increase-in-captive-insurance-use-in-2020-continuing-in-2021 (Sourced August 2021)

2 Anon, Aon https://www.aon.com/getmedia/a312b2f0-d63e-4a77-8de2-b5fb611356bb/Aon-Employee-Benefits-Captives-A-2020-Perspective.aspx (sourced August 2021)

3 Interview with Janaize Markland at Facebook, conducted by MAXIS GBN on 28 July 2021

4 Becky Bellamy, Captive Insurance Times https://www.captiveinsurancetimes.com/captiveinsurancenews/industryarticle.php?article_id=7036&navigationaction=industrynews&newssection=industry (sourced August 2021)

5 Mark Cook, Willis Towers Watson on Global Captive Podcast, https://www.globalcaptivepodcast.com/episodes/episode/91b34bb2/gcp-short-looking-back-on-a-year-of-covid-19-and-captive-eb-programmes (sourced August 2021)

6 Anon, L’Oreal https://www.loreal.com/en/group/about-loreal/our-purpose/social-innovation/ (sourced August 2021)

7 Anon, Saint Gobain https://www.saint-gobain.com/en/magazine/stories/when-company-becomes-driving-force-social-protection (sourced August 2021)

This document has been prepared by MAXIS GBN and is for informational purposes only – it does not constitute advice. MAXIS GBN has made every effort to ensure that the information contained in this document has been obtained from reliable sources, but cannot guarantee accuracy or completeness. The information contained in this document may be subject to change at any time without notice. Any reliance you place on this information is therefore strictly at your own risk. This document is strictly private and confidential, and should not be copied, distributed or reproduced in whole or in part, or passed to any third party.

The MAXIS Global Benefits Network (“Network”) is a network of locally licensed MAXIS member insurance companies (“Members”) founded by AXA France Vie, Paris, France (AXA) and Metropolitan Life Insurance Company, New York, NY (MLIC). MAXIS GBN, a Private Limited Company with a share capital of €4,650,000, registered with ORIAS under number 16000513, and with its registered office at 313, Terrasses de l’Arche - 92 727 Nanterre Cedex, France, is an insurance and reinsurance intermediary that promotes the Network. MAXIS GBN is jointly owned by affiliates of AXA and MLIC and does not issue policies or provide insurance; such activities are carried out by the Members. MAXIS GBN operates in the UK through its UK establishment with its registered address at 1st Floor, The Monument Building, 11 Monument Street, London EC3R 8AF, Establishment Number BR018216 and in other European countries on a services basis. MAXIS GBN operates in the U.S. through MetLife Insurance Brokerage, Inc., with its address at 200 Park Avenue, NY, NY, 10166, a NY licensed insurance broker. MLIC is the only Member licensed to transact insurance business in NY. The other Members are not licensed or authorised to do business in NY and the policies and contracts they issue have not been approved by the NY Superintendent of Financial Services, are not protected by the NY state guaranty fund, and are not subject to all of the laws of NY. MAR00907/0921